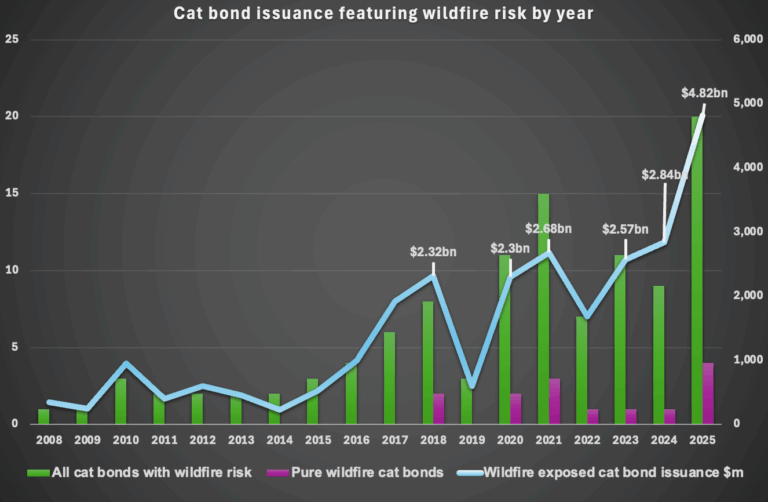

As wildfire risk models advance, wildfire catastrophe bonds are becoming a key part of the market, driven by California’s growing exposure and investor demand for diversification, according to Acrisure Re. The market has significantly expanded since its inaugural $200 million issuance in 2018; by 2025, wildfire-related cat bonds are expected to reach record issuance volumes.

The recent $40 billion losses from devastating California wildfires have highlighted the challenges in the state’s property insurance market, underscoring the need for effective reinsurance capital. Year-to-date, there has been $4.82 billion in new cat bond issuance linked to wildfire risk, surpassing the previous year’s $2.84 billion.

Improvements in modeling by firms like AIR Worldwide and RMS have enhanced confidence in quantifying wildfire risk. These updates allow investors to assess risks more accurately, leading to tighter pricing and more reliable structures. The evolution of wildfire cat bonds illustrates the insurance-linked securities market’s adaptability to emerging risks, with each major wildfire event since 2017 prompting refinements in pricing and risk-sharing approaches.

In summary, wildfire risk is becoming a mainstay in catastrophe bond portfolios, essential for enhancing resilience in the face of increasingly severe wildfires due to climate change.

Source link